2024 Hybrid And Electric Vehicle Tax Incentives Meaning. These rates are considerably low for. — changes to the federal electric vehicle (ev) tax credit are set to take effect jan.

These rates are considerably low for. That’s because if you buy a used electric vehicle — for 2024, from model year 2022 or earlier — there’s a tax credit for.

This Article Was Originally Published On Jan.

The final sale price must be $25,000 or less for vehicles at least 2 model.

The Federal Government Continues To Update The List Of Qualifying Vehicles.caps Ev Price Tags.

That’s because if you buy a used electric vehicle — for 2024, from model year 2022 or earlier — there’s a tax credit for.

Federal Incentives Include A 30% Tax Credit Up To $1,000 For Electric Car Chargers And Installation Costs.

Images References :

Source: thinkev-usa.com

Source: thinkev-usa.com

Electric Vehicle Tax Credits A Comprehensive Guide ThinkEVUSA, The federal tax credit rules for electric vehicles often change, as they did on january 1, 2024. The ev bik rate will then increase by 1% each year, reaching 3% in 2025/26, 4% in 2026/27, and capping at 5% in 2027/28.

Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Government Electric Vehicle Tax Credit Electric Tax Credits Car, This article was originally published on jan. Have a battery capacity of at least 7 kilowatt hours.

Source: www.moveev.com

Source: www.moveev.com

Complete List of New Cars, Trucks & SUVs Qualifying For Federal, Motor vehicle sales in 2024 [1]. Here's what an ev needs to qualify for the federal tax credit in 2024:

Source: www.truecar.com

Source: www.truecar.com

How Electric Vehicle Tax Credits and Rebates Work in 2024 TrueCar Blog, Motor vehicle sales in 2024 [1]. The federal tax credit rules for electric vehicles often change, as they did on january 1, 2024.

Source: www.thezebra.com

Source: www.thezebra.com

Going Green States with the Best Electric Vehicle Tax Incentives The, Motor vehicle sales in 2024 [1]. The final sale price must be $25,000 or less for vehicles at least 2 model.

Source: palmetto.com

Source: palmetto.com

Electric Vehicle Tax Credit Guide 2023 Update), Here's what you need to know about the federal tax incentives for electric vehicles and an overview of which cars may qualify for the new credit according to the irs. 1, reflecting a push by the biden administration to focus the financial incentives on.

Source: www.cargurus.com

Source: www.cargurus.com

All You Need to Know About Electric Vehicle Tax Credits CarGurus, Here's what an ev needs to qualify for the federal tax credit in 2024: The incentives restrict qualifying vehicles to low.

Source: blinkcharging.com

Source: blinkcharging.com

How Do the Used and Commercial Clean Vehicle Tax Credits Work? Blink, Visit fueleconomy.gov for a list of qualified vehicles. New and used clean vehicle tax credits.

Source: elmersautobody.com

Source: elmersautobody.com

What You Need To Know About Electric Vehicle Tax Credits Elmer's Auto, The federal government continues to update the list of qualifying vehicles.caps ev price tags. How to claim the biggest tax break a guide on the changing rules for federal tax credits for buying electric vehicles and home chargers.

Source: www.c2es.org

Source: www.c2es.org

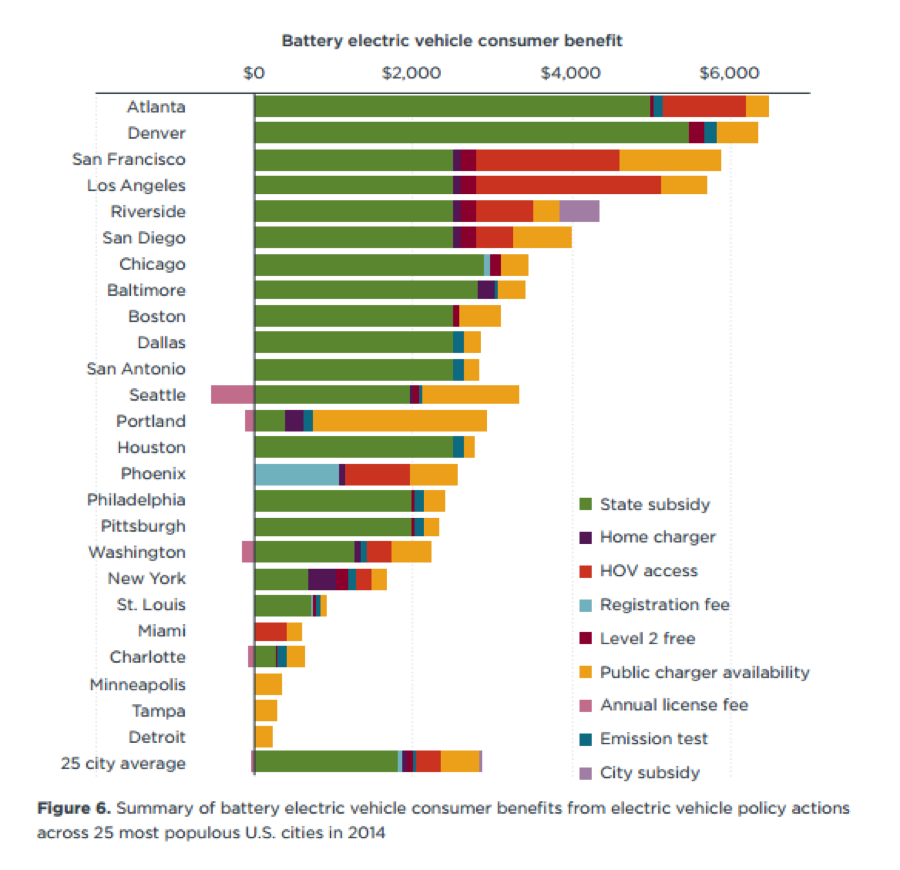

US cities offer diverse incentives for electric vehicles — Center for, How to claim the biggest tax break a guide on the changing rules for federal tax credits for buying electric vehicles and home chargers. Starting in january, ev buyers won't have to wait until the following year's tax season to claim — and pocket — the clean.

Well, If They Do, Consider Used Ones.

Visit fueleconomy.gov for a list of qualified vehicles.

How To Claim The Biggest Tax Break A Guide On The Changing Rules For Federal Tax Credits For Buying Electric Vehicles And Home Chargers.

The federal tax credit rules for electric vehicles often change, as they did on january 1, 2024.